Did you know that the mutual fund industry has seen stellar growth in September 2023?

In just six months, industry AUM went up by 20% to reach Rs. 48 lakh crore in September.

4 lakh new investors were added during this period, taking the total number to 4.09 crore.

Mutual fund distributors like you have played a pivotal role in creating financial awareness and improving financial inclusion.

| India Population | 144 Crores |

| Aadhar Card Holder | 136 Crores |

| Health Insurance Users | 51.5 Crores |

| UPI Users | 30 Crores |

| Stock Market Users | 13 Crores |

| Mutual funds Investors | 4.04 Crores |

Despite this tremendous growth, the income of MFDs has grown at a tepid pace.

What are the reasons behind this lack of growth? What are the challenges? How you can solve them and grow your business?

Let us understand.

What are the challenges faced by mutual fund distributors?

There are complaints about the difficulties that MFDs like you face in your business. Here are some of them:

- My Trail income will come down.

- I am facing difficulties in client acquisition and onboarding.

- Afraid of regulation and compliance.

- I think clients will leave to direct plans.

- Clients redeem frequently.

- Competition from fintech.

- I am not able to establish my brand.

You might face more than one of these challenges in your business. But what’s important is how you can overcome them.

So, let’s look at their possible solutions.

How can you solve these challenges and grow your business?

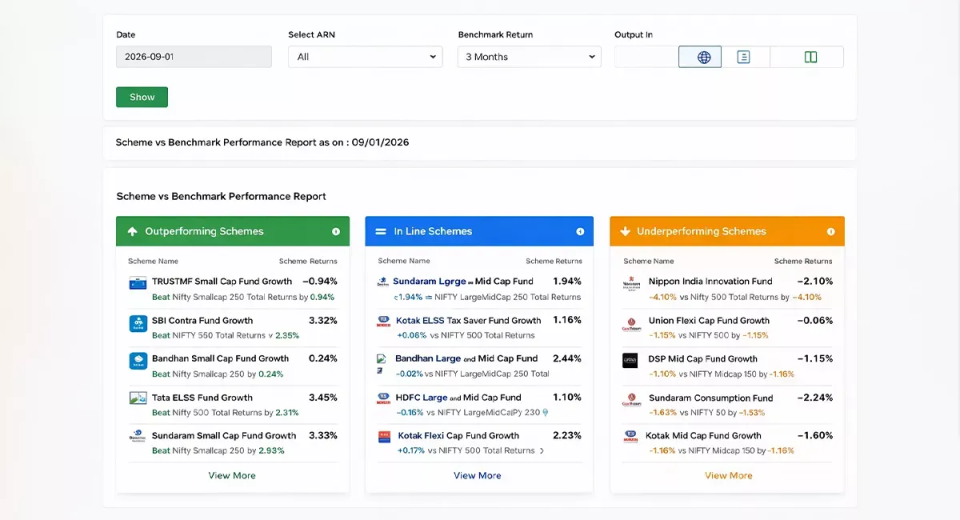

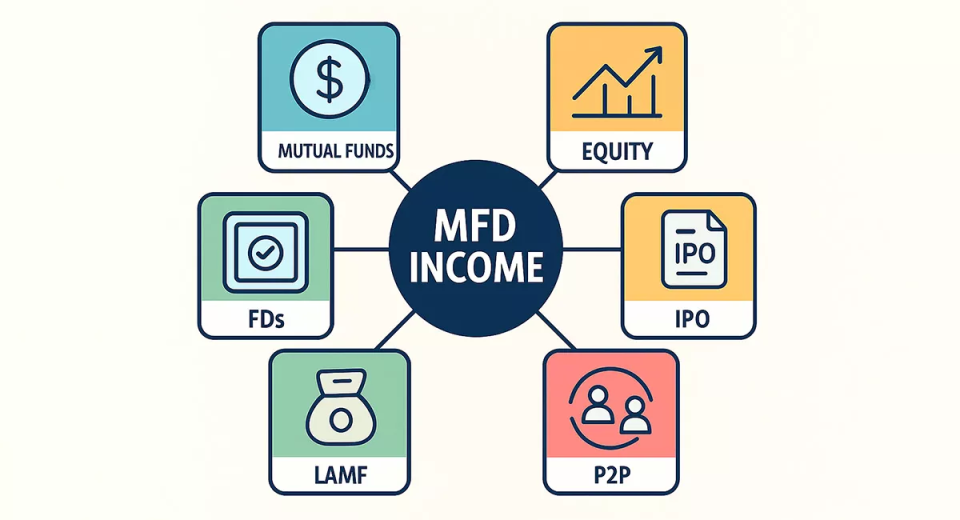

1. Trail income will come down Do more than mutual funds.

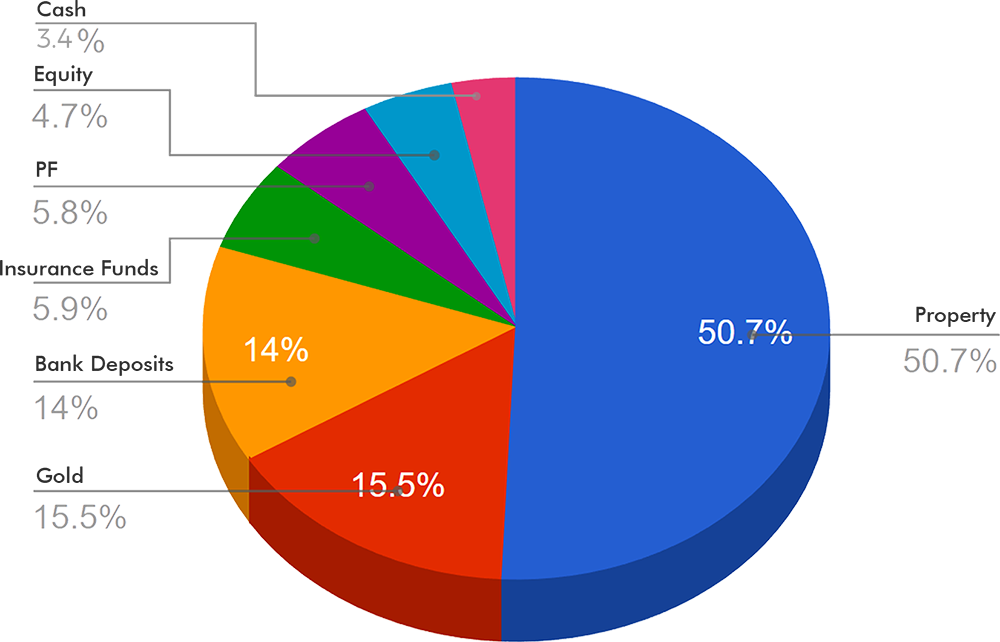

An interesting report from Jefferies revealed the current breakup of Indian household financial savings, showing that investors mostly prefer real estate, gold, and bank deposits.

Due to this reason, you end up getting a small portion of the investor wallets offering only mutual funds.

To overcome this challenge, you can offer investments in multiple assets and earn more.

Mutual fund software in India like ourselves is offering asset classes like global investments, NPS, P2P, and loans against mutual funds.

To know more, and get a free consultation, contact us today.

2. I am afraid of regulation and compliance Stay compliant with SEBI’s regulations.

As an MFD, you need to stay compliant with ever-changing regulations in the mutual fund industry.

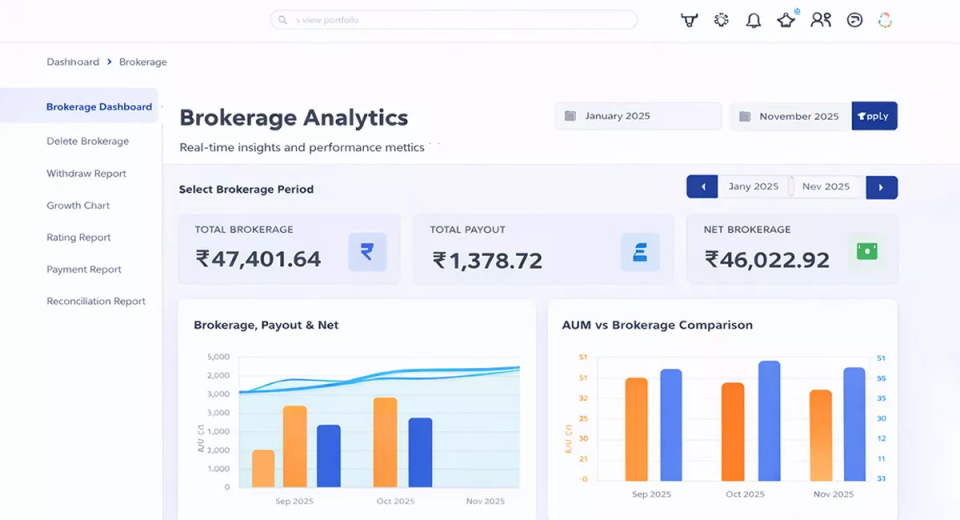

Mutual fund software with integrated compliance helps you streamline your business and follow the regulations.

3. Facing difficulty in client acquisition & onboarding Automate your business & onboard investors anywhere in the world.

You might have faced difficulty in onboarding your clients because:

Clients need to be registered with NSE, BSE, or MFU separately. It involves multiple steps, making it a time-consuming and complex process.

To solve this, we offer solutions like the Business Booster with KYC and registration on both NSE and BSE in one go.

4. Competition from direct platforms Compete and offer similar services.

What do direct platforms like GROWW, Zerodha, and 5Paisa offer their users?

- Accessibility

- Seamless onboarding

- Ease of investment

Why not embrace technology to offer simplified onboarding, ease of access, and one-click investments to your investors as well?

5. Frequent redemptions Stop Redemptions with loans against mutual funds.

During the market rally in the April-July period, redemption from equity-oriented schemes increased. There are multiple reasons behind investors redeeming their investments:

- Profit booking

- Short-term needs like marriage, education, etc.

This results in a loss of AUM and low trail income. To keep redemptions at bay, we offer loans against mutual funds to meet short-term needs and help stop redemptions.

6. Competition from peers Differentiate yourself from competitors.

With over 1.5 lakh ARN holders, there is heavy competition from fellow MFDs and other big players.

To tackle this, REDVision offers unique solutions to help you differentiate yourselves in the market and acquire new clients.

| Products | Features of these products | Benefits of these products |

| NPS | Tax-saving investment approved by the government. | It’s an easy-selling product. |

| Online ATM | Liquid funds investment with up to 7% returns. | Provide better returns than banks with instant redemptions. |

| Global Investments | Provides the ability to invest in FAANG companies. | Investors get the adv |

7. Marketing and branding Establish brand identity.

As of January 2023, the Association of Mutual Funds in India (AMFI) registered around 1.32 lakh MFDs. It’s easy to get lost in the crowd of hundreds.

To tackle this problem, we offer branding and marketing solutions, with 100% white-labeling including URL-based, Logo-based, and color-theme-based white labeling solutions.

This helps you establish your brand identity and reach more clients.

We also offer a digital marketing panel to help you promote your business on social media.

Conclusion

Mutual funds have seen unprecedented growth in the last few years. However MFD's earnings lag due to the difficulties in their business.

Technology has emerged as the solution for the above challenges. And it will be the biggest enabler for growth.

The one who transforms thrives, and the one who does not perish.

Let us help you transform your business.

Contact us today!