Hello distributors,

How are you doing? Hope you are good.

You might know that ChatGPT made waves in 2022 when its parent company launched the large language model.

ChatGPT is a chatbot that can answer your questions or complete a given task. But with AI making waves in the financial industry, people believe it is a potential competition and might replace humans. But is that so? Let us answer this question for you.

We will compare mutual fund distributors & AI on three fronts including personalized advice, dealing with emotions, and knowledge. Let us begin.

Personalized Advice

We know that wealth creation is the process of time & discipline and according to the research of Whiteoak Capital mutual fund, over the past 19 years the investors who remained in a mid or small-cap index fund since 2005 earned higher returns than the ones who switched their SIPs annually. The investors who remained invested earned 18%, and those who switched to best-performing funds every year earned only 15.5%. So, it becomes important for an individual to choose the right mutual funds according to their risk profile, time, and goals and stick to those funds for long-term wealth creation or get personalized advice. When asked in a personal interview, ChatGPT said as a language model AI, I can provide information and insights on personal finance, but I cannot provide personalized financial advice (including mutual fund selection). ChatGPT can answer basic personal finance questions as you go deeper, but these LLMs can’t give you a satisfactory answer.

Dealing with Emotions

Let us say, an investor started a SIP in 2006 to save for their dream home. During their journey, there were many events of market volatility including:

- Recession

- The U.S. fiscal cliff

- Federal Reserve to “taper” stimulus

- Oil prices plunge

- Chinese stock market sell-off

- Stocks at record highs, Bitcoin mania

- Trade wars, rising interest rates

- Covid Fall

- War & Inflation

- U.S Recession

- War, election, & Oil prices

But if an investor takes an exit due to panic or greed, then it disrupts the wealth creation journey for an individual.

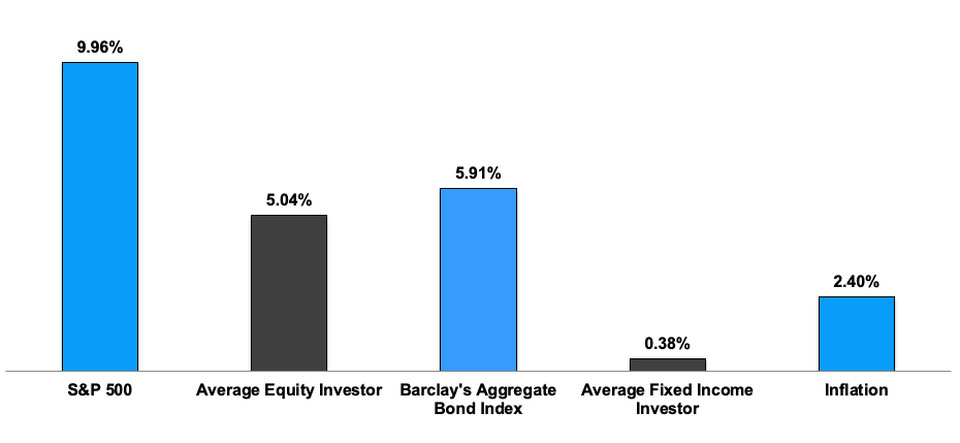

Infact according to a 2020 QAIB report, the S&P 500 had 30-year annualized returns of about 10%, whereas the average stock investor managed only half of that at about 5%.

2020

One major reason investor returns are considerably lower than index returns is that investors withdraw their investments during market crises.

However, mutual fund distributors can provide investors with emotional support and guidance during these times. They can do behavioral coaching to help clients continue their long-term wealth journey.

While they can’t rely on Robo advisors or ChatGPT.

Furthermore, investors can’t rely on ChatGPT for the right information due to the data it has been trained on.

Everyone is not a financial expert

Lastly, ChatGPT is a platform that provides answers based on the questions asked. So, one needs to have a thorough knowledge of the topic.

If you ask it a general question, then it will provide an answer that is general/one-solution-for-all.

Indeed, AI technology has made history. However, it can’t replace humans yet due to a lack of personalization and limited real-time knowledge.

Technology in mutual fund distribution is the perfect blend

While AI technology like ChatGPT can't replace the human touch, it can be a powerful tool to improve the efficiency of humans in:

Social media content creation: Tools like ChatGPT can help distributors write content for their website and social media whether it is brainstorming ideas, writing copy, or staying on trend.

Client communication & lead generation: MFDs can use chatbots on their website to provide basic information to potential investors and collect their information through qualifying questions.

Video KYC: Technology like wealth management software offer digital KYC feature to take care of

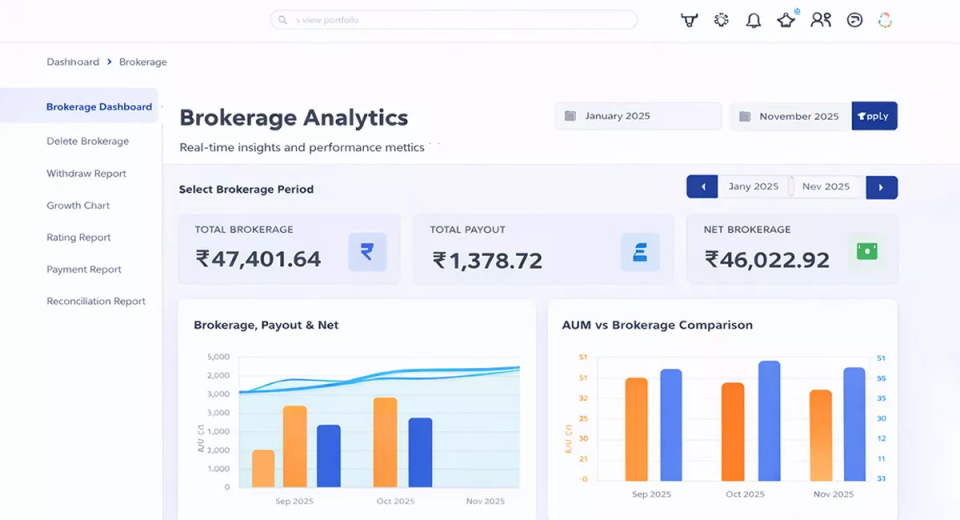

Goal-based investment: Distributors can use technology like wealth management software to plan goals for their investors like retirement, dream home, car, etc., map their existing investments, and make reports.

Reporting: This software can also help you access ready-made business insights reports like AUM, SIP book, etc.

But remember, ChatGPT is a tool, and like any tool, it is most effective when used strategically.

By integrating ChatGPT into your workflow, you can become a more efficient and effective mutual fund distributor, allowing you to spend more time building strong client relationships and delivering exceptional service.