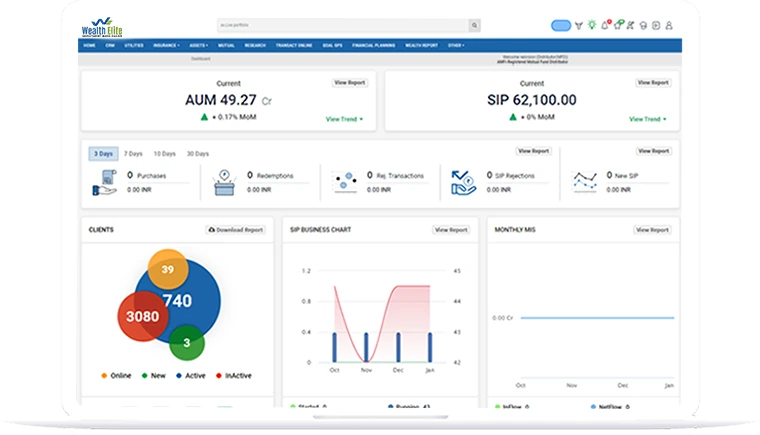

Leading Mutual Fund Software For Distributors in India

Wealth Elite is a White-labeled, SaaS platform for MFDs in India, equipped with advanced digital Client Lifecycle Management (CLM) solutions. It offers a wide array of features such as Powerful Business Intelligence, Multiple Assets, Automated Onboarding with Video KYC, seamless Online Transactions, an innovative Online ATM, Goal GPS, Portfolio Re-Balancing tools, Risk Profiling, Research Tools and Calculators, a Consolidated Account Statement, and so much more. This comprehensive Mutual Fund Software is designed to empower Mutual Fund Distributors by simplifying their operations and enabling them to provide better services to their clients at their fingertips.

Multi Assets

Goal Plan

Video KYC

Top Features

The Complete Life Cycle for Wealth Management

MFDs, understand your investors’ financial needs, health, and risk tolerance to better match their portfolios with future goals. Use these features to build trust with your investors by being transparent, improving loyalty, and offering personalized financial services tailored to their specific objectives.

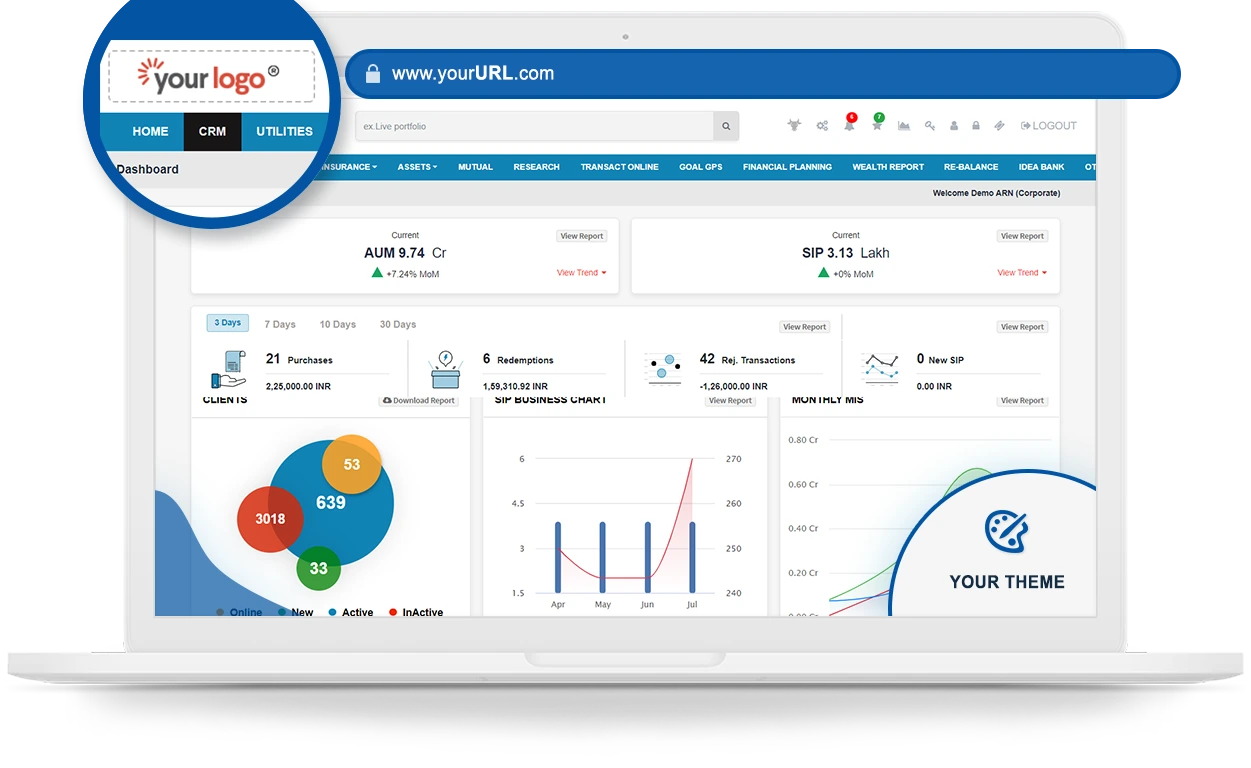

White-Labeling

Your Platform, Your Branding

White-labeling allows MFDs to offer fully customized Wealth Management Software that aligns with their brand. With a 100% white-labeled solution, everything from the website to the mobile app and backend software operates under the same branding, creating a seamless experience for investors. This consistent branding builds trust as investors feel more connected and comfortable navigating between platforms, without feeling like they’re switching between different brands.

Key Features

- URL-Based White-Labeling: The software will run on the same URL as your website (e.g., www.yourdomain.com), creating a cohesive experience.

- Color-Based White-Labeling: The software’s color theme matches your website’s theme, ensuring a consistent visual identity across all touchpoints.

- Logo-Based White-Labeling: The software displays your logo, or you can customize it to align with your unique brand, maintaining a strong identity for your business.

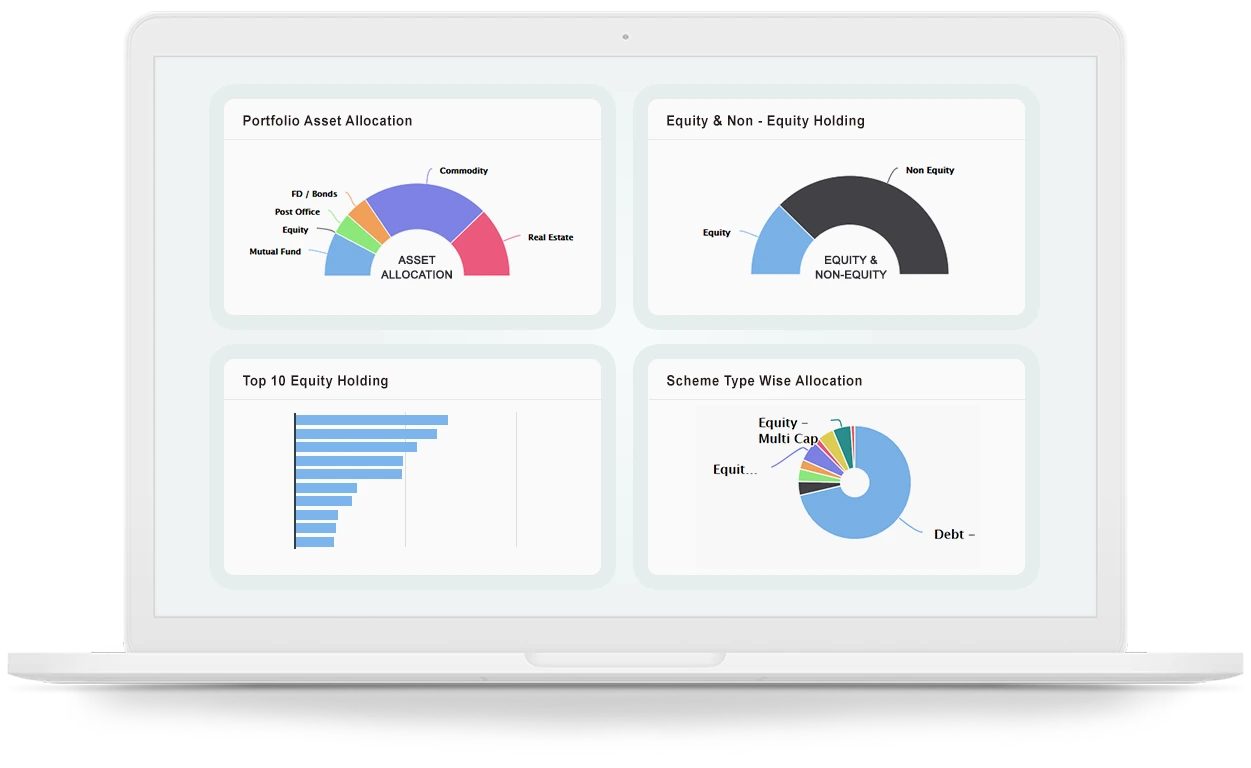

Multi Assets

Bird’s Eye View for 20+ Assets

Keep your investors satisfied by managing all their investments in one place. Get a clear view of their entire portfolio, so you can make better decisions and create smarter financial plans. From the asset classes mentioned below, you can connect everything to their goals, track their progress, and help them achieve their dreams. This simple and organized approach makes portfolio management easy and strengthens client trust.

Note: While transactions aren’t offered for these, you can seamlessly manage:

Key Features

- PMS & Alternative Investments: High-net-worth investment options tailored to clients' needs.

- Fixed Deposits (FDs) & Bonds: Stable, low-risk investments for assured returns.

- Postal Schemes: Government-backed small savings plans.

- Equity: Manage Indian and US stock market portfolios.

- Commodities: Track investments in gold, silver, and other traded goods.

- Real Estate: Organize property investments for a holistic view.

Powerful Portfolio Analysis

Track Portfolios with Detailed Reports

Stay on top of investor portfolios with bifurcated reports, ranging from Equity Holding Reports to Return Reports (XIRR, CAGR) and P&L Reports to Capital Gain Reports. Generate over 40 types of detailed, highly visualized reports that are easy to read and understand. Additionally, use features to assess potential outcomes for your investors with just a few clicks. These reports in back-office software provide clear and accurate insights, helping investors stay informed about their financial journey.

Key Reports

- Equity Holding Report: See the stocks investors own and their current value.

- Return Report (XIRR, CAGR): Check how well investments are performing with clear return numbers.

- P&L Report: Get a simple view of profits and losses over time.

- Capital Gain Report: Easily see tax-related capital gains for filing purposes.

- What If Scenario: Try out different investment ideas and see possible results.

- 40+ Other Reports: View reports on things like asset allocation, goal tracking, and more.

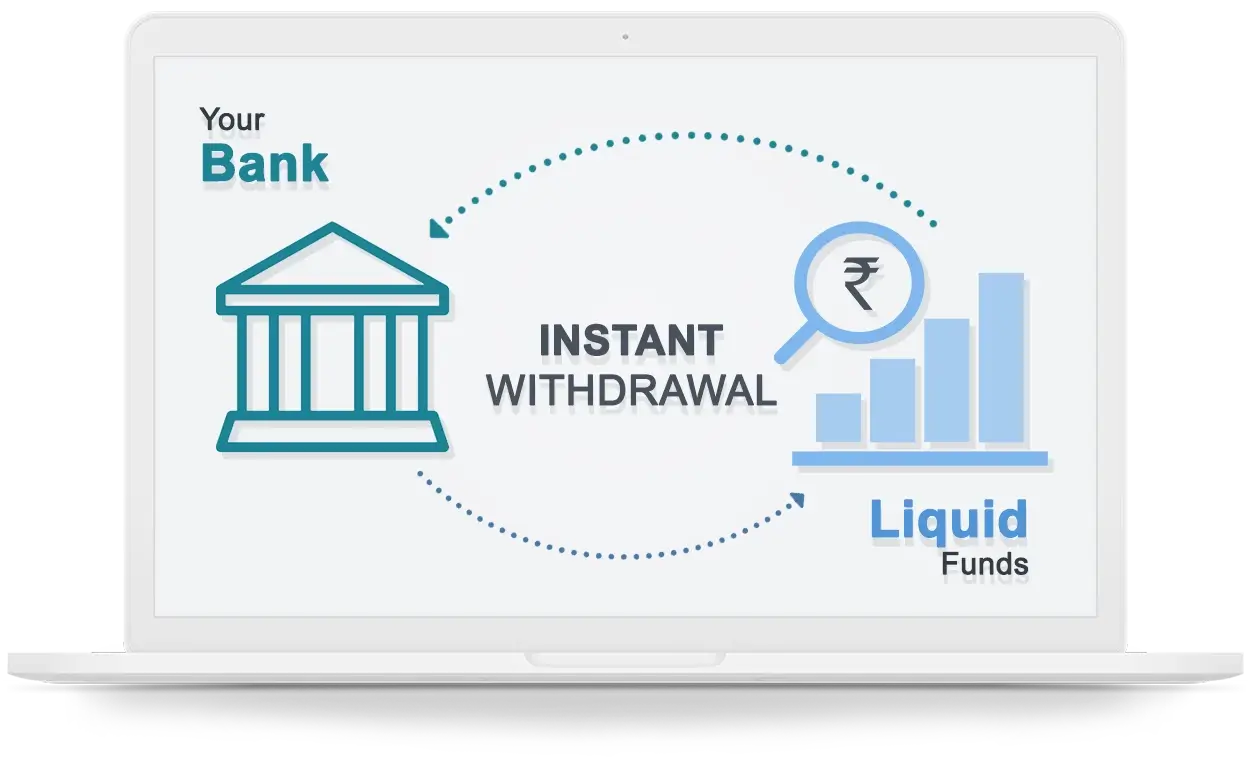

Online ATM

Liquidity of Savings - Better Returns Than FDs!

Transform the way investors think about their savings by shifting money from traditional bank deposits to liquid funds. With the Insta Redemption feature, investors can access their funds instantly when required. They can withdraw up to ₹50,000 or 90% of their invested amount (whichever is smaller) within 30 minutes using the Online ATM, directly transferring the funds to their bank account.

Key Features

- Insta Redemption: Allows quick withdrawal of funds when needed.

- Online ATM: Enables instant withdrawals of up to ₹50,000 or 90% of the investment.

- Liquid Funds: Offers a safer and more profitable alternative to bank FDs.

- Instant Bank Transfer: Funds are transferred directly to the investor's bank account.

- Boost Investment: Encourages people to move their idle bank savings into liquid funds for better returns.

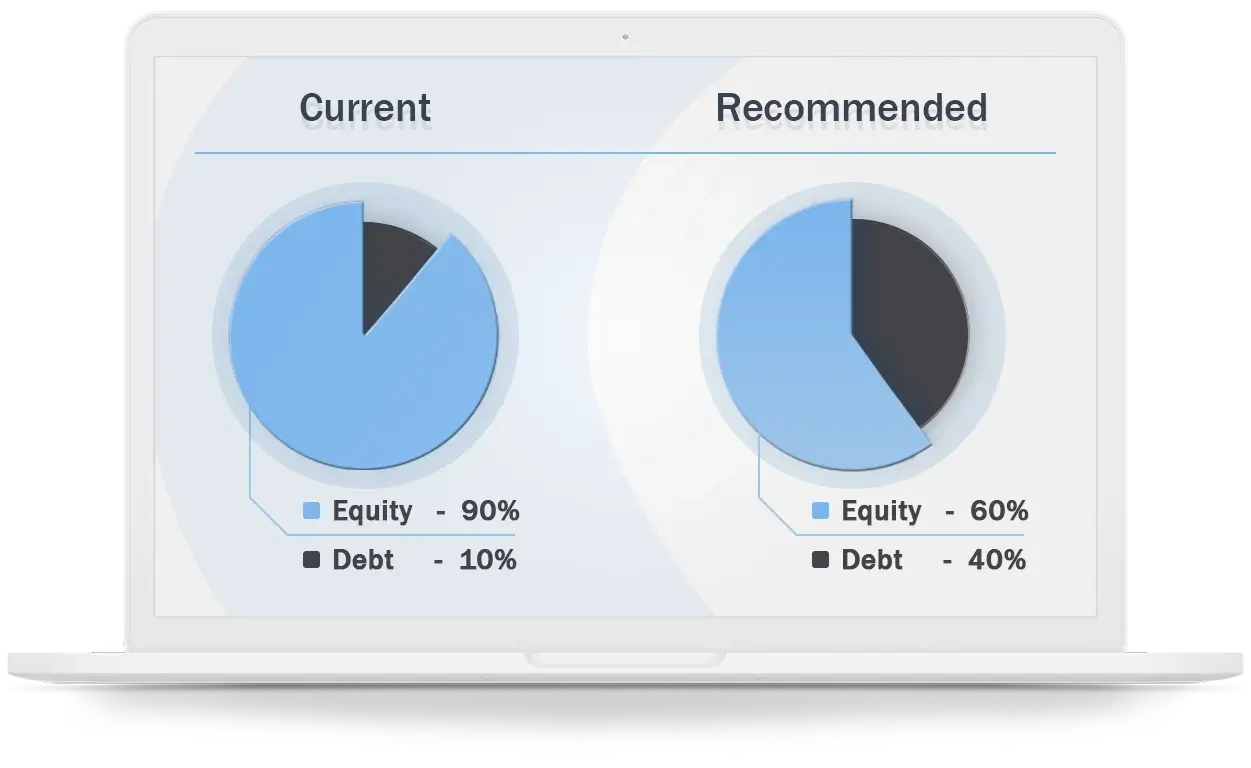

Portfolio Rebalancing

Smart Product Engineering for Better Asset Management

Set yourself apart from the competition by offering personalized investment plans. You can set targets based on your clients' risk levels and invest in equity and debt accordingly to balance risk and returns. If there's any change in the target, automatic email alerts will notify both the investor and MFD. With integration to BSE & NSE, you can place switch orders directly from the rebalancing report.

Key Features

- Fixed Time Interval-based Rebalancing: Adjust the investments at set time intervals to keep the portfolio in line with goals.

- Percentage Change-based Rebalancing: Rebalance when a specific asset reaches a set percentage, ensuring the portfolio stays on track.

These strategies help MFDs maintain portfolios that meet client goals while making the process simple and efficient.

Get Started

Goal Tracker

Ensuring Long-Term Success for Your Clients

Goal GPS helps MFDs strategically align their clients' investments with their long-term goals, fostering a sense of commitment and reducing the likelihood of early redemptions. By linking investments directly to personal milestones, such as education, buying a car, or retirement, clients stay focused on their goals and are more likely to maintain their investments for the long haul. This not only helps clients achieve their objectives but also ensures a stable AUM for MFDs.

Key Features

- Goal Planning: Plan for important milestones like child education or car purchase.

- Structured Fund Mapping: Align investments across various asset classes.

- Emotional Connection: Add goal-related photos to build a stronger emotional attachment.

- Seamless Fund Mapping: Map new funds to existing investments for smooth portfolio management.

- Regular Goal Tracking: Keep track of progress with consistent updates.

- Comprehensive Goal Summary: Generate clear, detailed reports to monitor progress.

Financial Planning

Plan Today, Secure Tomorrow

Help your clients make the most of their financial resources with a structured financial planning process. Identify their goals, future objectives, existing assets, and any financial challenges or liabilities. Map their future financial goals with their current financial health to create personalized, goal-based reports. These reports include features like Insurance Need Analysis, Post-Retirement Cash Flows, Asset Allocation Recommendations, Net Worth Analysis, and Auto-Ratio Calculations, all designed to provide clarity and actionable insights.

Key Features

- Goal Planning: Insurance Need Analysis: Assess and address gaps in insurance coverage.

- Post-Retirement Cash Flows: Ensure clients have a clear retirement income plan.

- Asset Allocation Recommendations: Optimize portfolios across asset classes.

- Net Worth Analysis: Provide an in-depth overview of assets and liabilities.

- Goal-Based Reporting: Include personal touches like goal photos for emotional connection.

- Auto-Ratio Calculations: Automate financial metrics for quick and accurate insights.

Video KYC

Paperless and Digital Onboarding

Video KYC is a game-changing feature in portfolio management software that automates the entire onboarding process, eliminating the need for tedious paperwork. It ensures a seamless and efficient client experience by digitizing the KYC process, making it faster, safer, and more accurate. With Video KYC, MFDs can onboard clients from anywhere in the world without the hassle of physical visits, saving time while maintaining compliance with ease.

Key Features

- Paperless, Seamless, and Digital: No more paperwork or manual processes.

- Instant Video-Based KYC: Clients can complete KYC via a secure invitation link.

- Global Access: Conduct KYC for clients from any location.

- Remote Process: No need for clients to visit the office physically.

- Time-Saving: The entire process is completed within minutes.

- High Accuracy: Video verification ensures fewer errors compared to manual KYC.

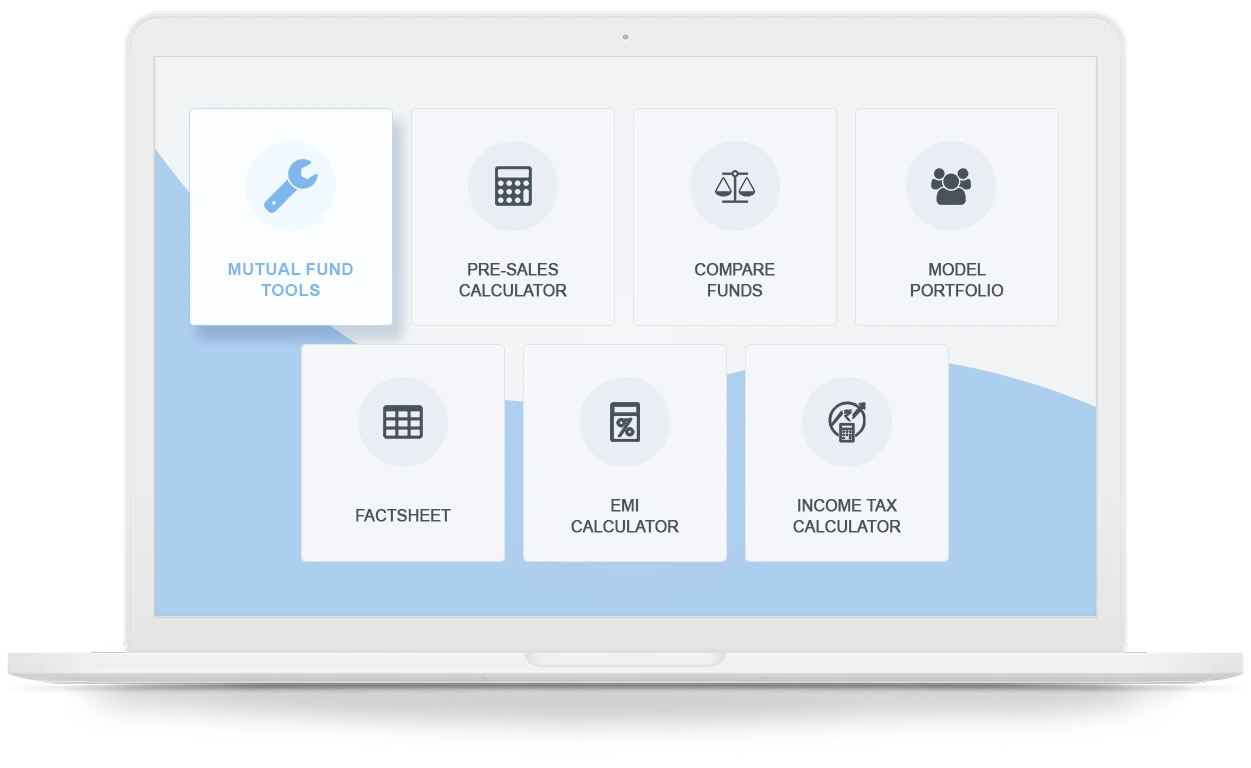

Research Tools & Calculators

Wide-Ranging Research Tools for Better Financial Planning

Our research tools make financial planning faster, more accurate, and error-free. With financial calculators, MFDs can easily assist investors in planning their investments and retirement goals. Additional features help MFDs evaluate different investment options and select the best strategies for clients' needs. These tools simplify complex calculations and provide valuable insights.

Key Features

- Financial Calculators: SIP, Step-Up SIP, Lumpsum, Crorepati, STP, SWP, Retirement Planning, and more.

- Compare Fund: Compare different funds to find the best options.

- Fund Factsheet: Access detailed information about various funds.

- Model Portfolio: Get recommendations for diversified investment portfolios.

- SIP Performance: Track the performance of SIP investments.

- Rolling Return: Analyze long-term returns with rolling return metrics.

- STP & SWP Performance: Measure the performance of Systematic Transfer and Withdrawal Plans.

- Scheme Performance: Evaluate the performance of different schemes.

- Top Performance: Identify top-performing funds and schemes.

Online Transactions

Save Time, Paper, and Effort with Seamless Transactions

Our integrated solution allows MFDs and investors to enjoy secure, instant transactions anytime, anywhere through platforms like NSE NMFII, BSE StarMF, and MFU. It streamlines the process, saving time and eliminating paperwork. Bulk client onboarding becomes effortless, and unlimited transactions (buy, sell, switch) help optimize returns. Additionally, MFDs can sort and categorize AMCs to recommend the best schemes, offering clients a personalized investment experience.

Key Features

- Saves Time & Effort: Instant, secure transactions with no paperwork.

- Bulk Client Onboarding: Easily onboard large numbers of investors without extra formalities.

- Bulk Transactions: Unlimited transactions for better market returns.

- Sort AMCs: Categorize top AMCs based on clients' preferences.

- Integrated with NSE/BSE + MFU: Seamless access to the best platforms for investors and MFDs.