Trusted

Business Management App for MFDs

Brings complete Business of MFDs at their fingertips. Place MF transactions on behalf of clients, share reports on Whatsapp, track clients’ portfolios, and much more.

Place MF Transactions !

Reports on Whatsapp !

Goal GPS !

Portfolio Analysis !

Research !

Top Features

Brings complete Business of MFDs at their fingertips

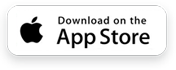

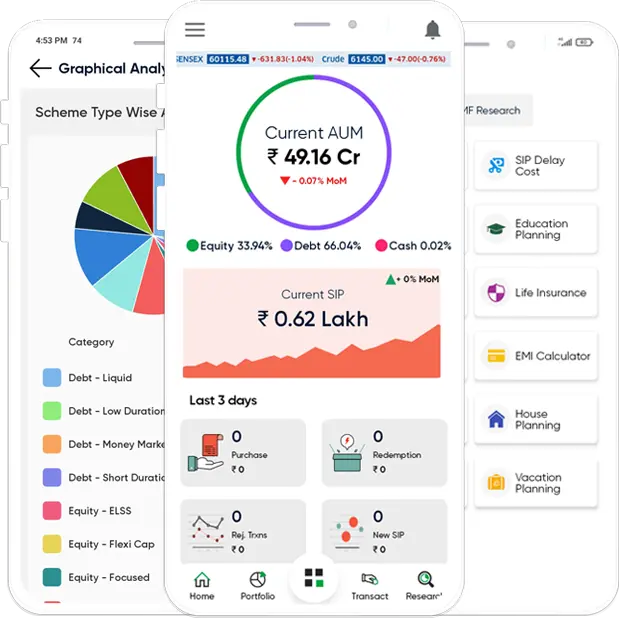

Productive Dashboard

Dashboard shows latest AUM & SIP trends of the last 4 months with recent purchases, redemption, and rejected transactions. Also presents new SIPs, and upcoming business reports.

Get Started

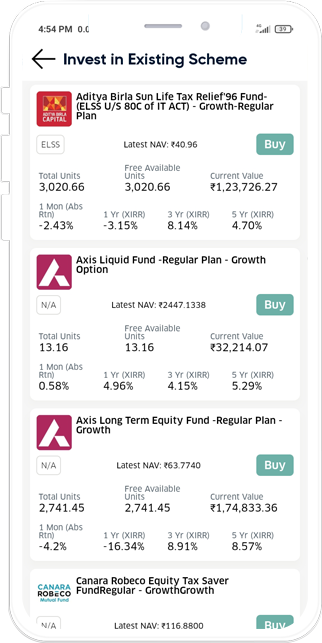

Place Smart Transactions

MFDs can place purchase, redemption & SIP orders on behalf of Investors and auto-share payment link with the Investors.

Get Started

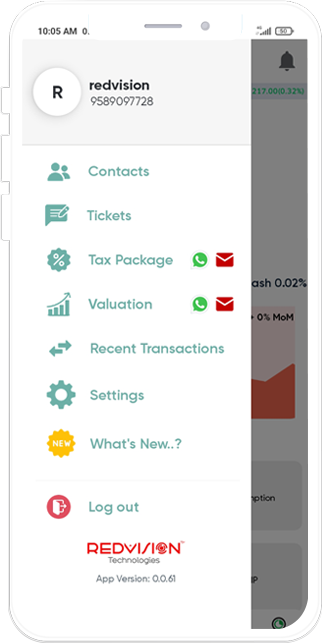

Share Reports on Whatsapp

MFDs can send various reports to investors including Valuation, Capital Gain, financial year wise transaction reports, etc. on whatsapp in a few clicks.

Get Started

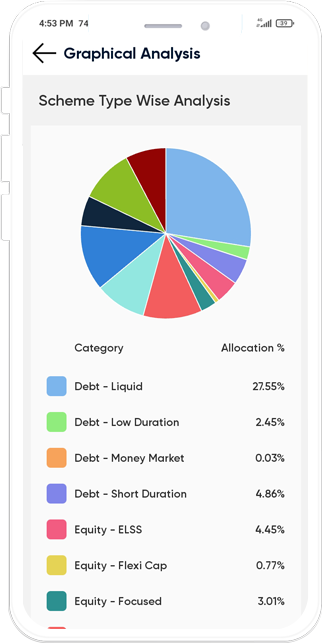

Powerful Portfolio Analysis

Analyze asset allocation, top equity & debt holding, sector exposure, XIRR returns. Check portfolio profitability on the go, and send portfolio reports to investors easily on Whatsapp!

Get Started

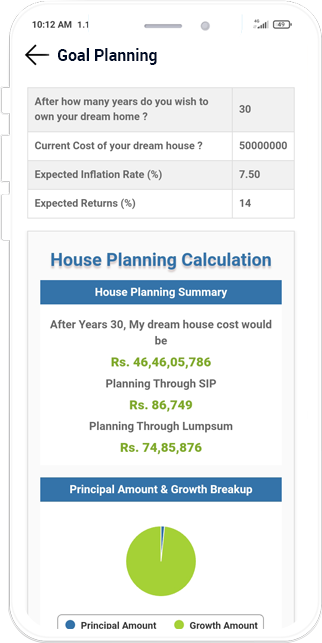

Goal GPS

Simulate the future goals of investors, track their achievements, calculate their current return and required return. Make clients, long term investor and slowdown investment redemption rate.

Get Started

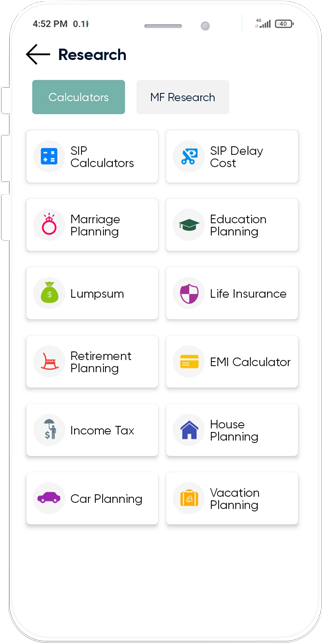

Research

Get various NAV Based calculators and income tax estimator only on Advisor X. Advisor X makes it easy to research for best funds in the markets as per investor’s requirement.

Get Started