How can MFDs thrive in the bull run with mutual fund software in 2024?

You might know that the MF industry has grown quite rapidly in the last 10 years, from 11 lakh crore AUM to about ₹48.75 trillion in November 2023.

It’s about 18-20% growth every year!

Industry experts see mutual funds attracting a bigger slice of households’ financial assets in the years to come.

Their share was under 9% as of March 2023, versus about 45% for bank deposits.

Factors driving growth in mutual funds:

- Rising financial literacy among Indians as more people recognize the importance of long-term investing and diversification.

- Improving incomes allows more households to set aside funds for retirement and children's education.

- The COVID-19 pandemic highlighted the need for emergency funds and triggered job losses, pushing people towards mutual funds for stability.

- Stellar market returns in recent years have attracted investors and shown the potential for long-term growth.

However, there is a problem!

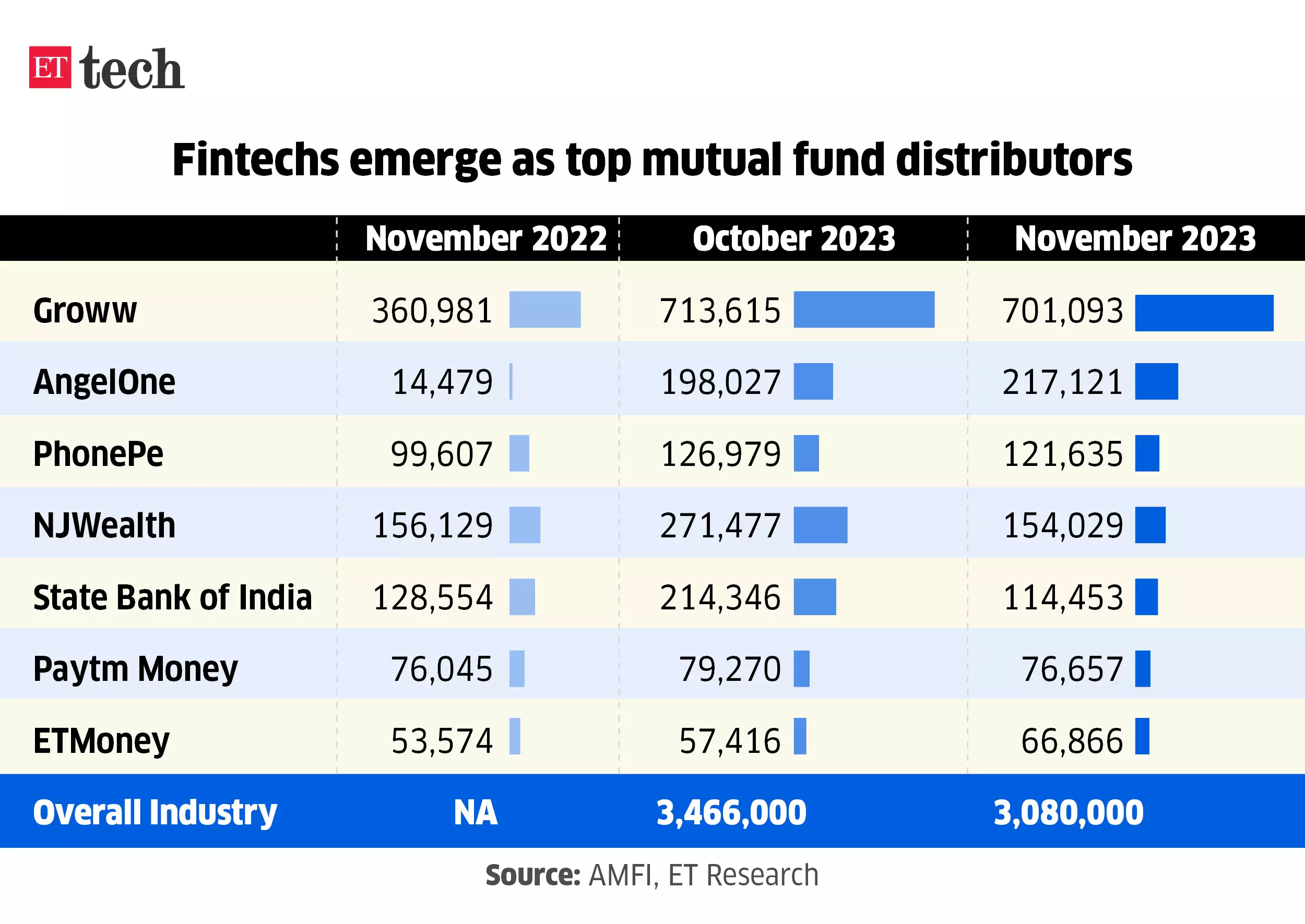

A large chunk of the new user addition for the entire industry is happening through fintechs.

The rise of fintech platforms

Did you know? According to the Association of Mutual Funds of India, over 3 million new SIPs were created in November 2023.

Out of 3 million SIPs, around 1.3 million were opened on fintech platforms, according to industry estimates.

What has led to this growth?

More and more investors are investing in mutual funds through the direct route.

These apps are providing them with a good user interface, which is helping them grab market share.

In addition to this, these platforms offer investors access to online portals and mobile apps.

It provides comprehensive information, real-time updates, and streamlined transactions.

How do fintech platforms use mutual funds as a hook to cross-sell?

Unmask their true motive: "While mutual funds act as an entry point, fintech startups view them as a launchpad.

Their real revenue stream lies in wealth management services, broking, and other fee-generating offerings."

How can MFDs compete with fintech platforms and thrive in 2024?

- Develop a branded app with a curated selection of mutual funds and additional features like goal-based investing, performance tracking, etc.

- Launch targeted social media campaigns promoting your funds and educating followers. Create regular videos explaining financial concepts in simple terms.

- Offer investment products such as IPOs - Stop your clients from going direct. You can offer pull products like IPOs with mutual fund software like REDVision*.

This will provide a seamless customer experience.

This will stop your clients from going to direct platforms and increase your wallet share.

Conclusion

In summary, the mutual fund industry has grown rapidly due to rising awareness, incomes, and changing preferences towards convenient digital investing.

While fintechs have disrupted the space, you can thrive by embracing technology solutions, enhancing the customer experience, and implementing creative marketing strategies to attract and retain investors in 2024 and beyond.

It has become important for you to get the best technology and revamp your business practice in 2024.

Want to know how we can help you manage your business efficiently? Contact us today!

* IPO’s will be available soon on REDVision (under integration).